The calendar flips, and so does your budget. As a personal finance aficionado, you know that the change of seasons isn’t just about wardrobe—it’s about a complete shift in spending habits. But which season truly claims the title of “Most Expensive”?

The truth is, both summer and winter are fierce competitors for your hard-earned money, though they hit your budget in very different ways. For many households, winter typically edges out summer as the most expensive season, primarily due to the concentrated expense of the holidays. However, summer can be a close second, especially for families.

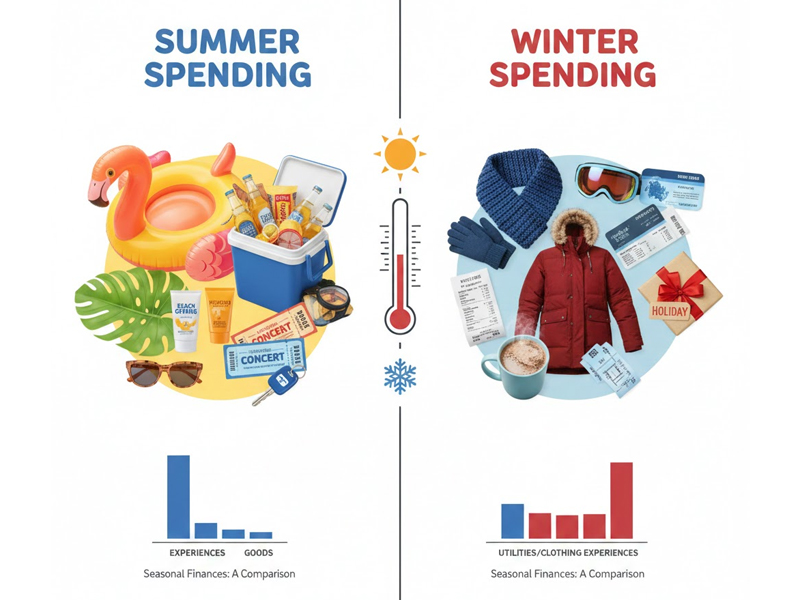

Here is a breakdown of the typical financial battles you face each season.

The Winter Budget Battle: High-Cost, Concentrated Spending

Winter’s expenses are often necessary and concentrated, making them feel particularly burdensome.

The Big Three Winter Costs:

- Heating Bills: This is the most unavoidable core expense. Whether you’re using natural gas, oil, or electricity, keeping your home warm when temperatures drop drastically increases your utility costs. For those in colder climates, this can easily add hundreds of dollars per month to your fixed expenses.

- Holiday Spending: This is the major budget-buster. The period from Thanksgiving through New Year’s is a flurry of expenses:

- Gifts: The cost of buying presents for family and friends.

- Travel: High prices for peak-season flights and holiday-related travel to see relatives.

- Festivities: Money spent on parties, formal attire, decorations, and hosting elaborate meals.

- Winter Gear & Maintenance: Buying heavy-duty winter clothing (coats, boots, snow gear) and the potential for increased home maintenance (e.g., snow removal, winterizing your home, fixing weather-related damage) can be costly.

- The Takeaway: Winter’s high costs are often non-negotiable (utilities) or driven by intense social and cultural pressure (holidays), leading to high debt in January.

The Summer Budget Battle: Discretionary Spending Spree

Summer’s expenses tend to be more discretionary and driven by leisure and activity. While you have more control over this spending, the cumulative effect can be just as damaging.

The Major Summer Spends:

- Vacations and Travel: This is the single biggest expense for many during the summer. Peak travel season means higher prices for:

- Flights and Hotels: Demand drives up the cost of accommodation and transportation.

- Activities: Amusement parks, concerts, and major sightseeing spots cost a premium.

- Childcare and Activities: For families, the long school break is a huge financial hurdle. Costs include:

- Summer Camps: Often a necessity for working parents, these can be extremely expensive.

- Increased Food Costs: Kids are home and eating more, leading to higher grocery bills.

- Family Fun: Frequent trips to the zoo, pool, movies, or other paid outings.

- Cooling Bills: Just as heating is expensive in winter, air conditioning can skyrocket electricity bills in the summer, especially in warmer climates or older, less-efficient homes.

- Social Outings: Weddings, BBQs, patio dinners, and general social activities are more frequent, all of which chip away at your dining and entertainment budget.

- The Takeaway: Summer’s high costs are primarily driven by leisure and lifestyle. While you could technically stay home, social and familial pressure often makes it feel mandatory to spend.

The Verdict: It Depends on Your Lifestyle and Location

The most expensive season ultimately comes down to your personal circumstances:

| Your Scenario | Likely Most Expensive Season | Why? |

| Northern Climate / High Social Calendar | Winter | The combined, unavoidable cost of heating + the heavy pressure of holiday travel and gifting. |

| Family with Young Children / Traveler | Summer | The cumulative cost of camps, peak-season family vacations, and constant daily activities. |

| Southern Climate / Minimal Travel | It Could Be a Tie | Your high AC bills in summer will compete with high holiday costs in winter. |

| Frugal & Anti-Holiday Spender | Summer | If you cut back on gifts and don’t host, your summer utility and leisure costs will likely exceed your minimal winter expenses. |

How to Tame Your Seasonal Spending

Regardless of which season is your biggest threat, the key to financial success is seasonal budgeting.

- The 12-Month Rule: Don’t wait for December to budget for Christmas gifts, or for June to pay for camp. Divide your expected annual seasonal expenses by 12 and save that amount monthly into a sinking fund.

- Example: If your expected winter holiday spend is $\$1,200$, save $\$100$ every month of the year.

- Audit Your Utilities: Before the season hits, do an energy audit. In winter, seal drafts and check insulation. In summer, clean your AC unit filter and use blackout curtains. This minor work can lead to major monthly savings.

- Find Free Fun: Counter high-cost travel and events with free activities. Summer offers free community festivals, parks, and libraries. Winter offers free sledding, ice skating in some cities, and low-cost movie nights at home.

By recognizing when and why your spending surges, you can prepare your personal budget year-round and ensure neither extreme season derails your financial goals.