Financial planning for retirement can feel overwhelming when you reach your 40s or 50s and realize you’re significantly behind where you should be. Whether due to student loans, career changes, raising children, divorce, medical expenses, or simply not prioritizing savings in your younger years, finding yourself with inadequate retirement savings is more common than you might think. The good news is that while starting late presents challenges, it’s far from a hopeless situation. With strategic planning and disciplined execution during your peak earning years, you can still build meaningful retirement security.

The mathematics of compound interest work against late starters in powerful ways. Someone who begins saving $500 monthly at age 25 will accumulate over $1.1 million by age 65, assuming a 7% annual return. That same $500 monthly contribution starting at age 45 grows to only about $260,000 over twenty years. This stark difference illustrates why early saving is so often emphasized. However, the reality is that most people in their 40s and 50s earn significantly more than they did in their 20s, creating opportunities to save much larger amounts that can partially offset the lost time.

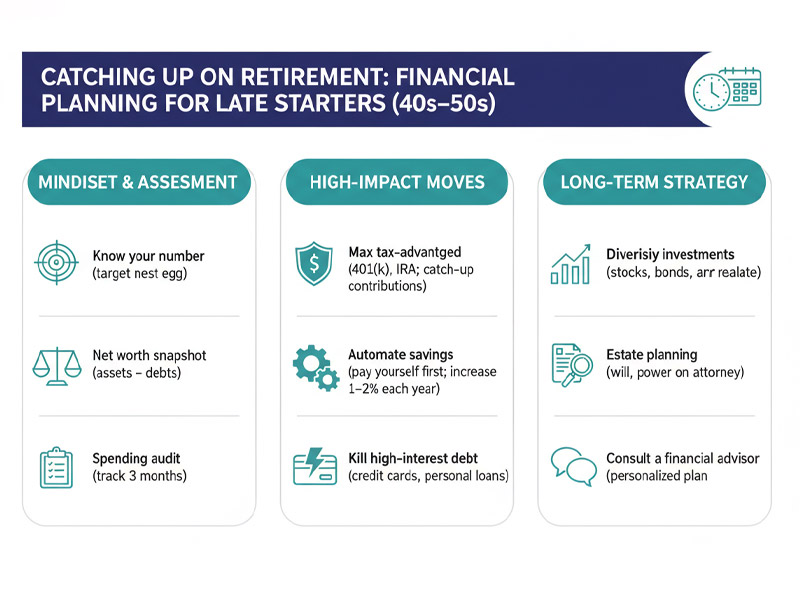

Understanding where you stand is the critical first step. Financial advisors typically recommend having two to three times your annual salary saved by age 40, four to six times by age 50, and seven to nine times by age 60. If you’re earning $70,000 annually at age 50, you should ideally have between $280,000 and $420,000 saved for retirement. Most Americans fall short of these benchmarks, but knowing your specific gap helps create a realistic action plan. Calculate your current savings, estimate your desired retirement lifestyle costs, and determine how much you need to save monthly to reach your goals.

Maximizing retirement account contributions becomes non-negotiable for late starters. The IRS provides special catch-up contribution provisions for those over 50, allowing an additional $7,500 annually in 401(k) accounts and $1,000 in IRAs beyond standard limits. This means someone over 50 can contribute up to $30,500 to a 401(k) and $8,000 to an IRA each year. While these amounts may seem impossible, remember that you’re likely in your peak earning years. Every raise, bonus, or windfall should flow directly into retirement accounts rather than lifestyle upgrades. Living on the income you had five years ago while directing all income growth to retirement savings can dramatically accelerate wealth building.

Aggressive expense reduction often provides the necessary cash flow for increased retirement contributions. Housing typically represents the largest expense category, making it the highest-impact area for optimization. Consider whether downsizing, relocating to a lower cost-of-living area, or taking in a roommate could free up substantial monthly income. Transportation costs also offer significant reduction opportunities through driving paid-off vehicles longer, eliminating car payments, or becoming a one-car household. The key mindset shift involves viewing these changes not as permanent deprivation but as temporary sacrifices during a focused 15-20 year wealth-building period.

Career optimization during your 40s and 50s can significantly impact retirement readiness. These should be your highest-earning years, making aggressive pursuit of promotions, raises, and potentially even career changes to higher-paying fields worth considering. Don’t shy away from salary negotiations or from seeking better-compensated positions elsewhere. Additionally, developing side income streams through consulting, freelancing, or small business ventures can provide extra funds dedicated entirely to retirement savings. Even an additional $10,000-20,000 annually from side work, invested consistently, can add $250,000-500,000 to retirement savings over 15-20 years.

Debt elimination deserves careful strategic consideration for late starters. High-interest credit card debt should be eliminated immediately since paying 18-25% interest rates makes building wealth nearly impossible. However, decisions about mortgage payoff become more nuanced. Entering retirement without a mortgage payment dramatically reduces required retirement income, but aggressively paying off a 3-4% mortgage while behind on retirement savings may not be optimal. A balanced approach might involve making modest extra principal payments while prioritizing retirement account contributions. The key is ensuring you reach retirement debt-free while still building adequate investment portfolios.

Social Security optimization becomes particularly important for those with limited retirement savings. While conventional wisdom often suggests claiming benefits as early as possible, late starters should strongly consider delaying Social Security until age 70. Waiting from age 67 to 70 increases monthly benefits by 24% for life, providing significantly more income during later retirement years when other assets may be depleted. This strategy works best when you can use other savings to bridge the gap between retirement and age 70, then rely on maximized Social Security benefits for the remainder of your life.

Adjusting retirement expectations may be necessary for some late starters. This doesn’t mean resigning yourself to poverty, but rather accepting that retirement might look different than originally imagined. Working until age 70 instead of 65 provides five additional years of contributions, five fewer years to fund, continued healthcare coverage, and higher Social Security benefits. Part-time work during early retirement years can supplement savings while keeping you engaged and active. Geographic relocation to lower cost-of-living areas, whether domestically or internationally, can dramatically reduce retirement spending needs and stretch limited savings much further.

The psychological aspect of late-start retirement planning shouldn’t be underestimated. Feelings of regret, shame, or hopelessness about past financial decisions can paralyze action precisely when aggressive steps are most needed. Instead of dwelling on what should have been done differently, channel that energy into maximizing the years ahead. Every dollar saved today is exponentially more valuable than money spent on lifestyle inflation. The temporary sacrifice of living below your current means enables decades of financial security in retirement.

Starting retirement planning late is not ideal, but it’s infinitely better than not starting at all. The combination of maximized contributions, aggressive savings rates during peak earning years, strategic expense reduction, career optimization, and realistic retirement expectations can still create comfortable retirement options. The critical factor is taking immediate, decisive action rather than waiting for circumstances to improve. Your future self will be grateful for the discipline and sacrifices you make today to build retirement security despite the late start.